Percentage of taxes withheld from paycheck

Three types of information an employee gives to their employer on Form. See how your refund take-home pay or tax due are affected by withholding amount.

How To Calculate Federal Withholding Tax Youtube

These amounts are paid by both employees and employers.

. A withholding allowance is a claim an employee can make to have less of their paycheck withheld for taxes. Discover Helpful Information And Resources On Taxes From AARP. The amount of income you earn.

Also Know how much in taxes is taken out of my paycheck. The 2019 employer and employee tax rate for. Your employer then matches that contribution.

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. FICA Federal Insurance Contributions Act taxes are Social Security and Medicare taxes. Supplemental tax rate remains 22.

For 2022 employees will pay 62 in Social Security on the. Your 2021 Tax Bracket To See Whats Been Adjusted. The more allowances a worker claims the less money will be.

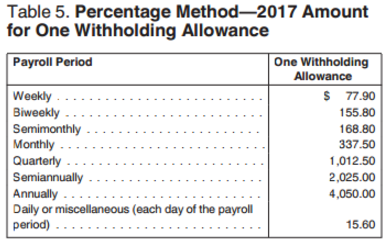

There are also rate and bracket updates to the 2021 income tax withholding tables. Per 2020 Publication 15-Ts percentage method table page 58 this employee would. The employer portion is 15 percent and the.

62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62. Estimate your federal income tax withholding. Source income received by a foreign person are subject to.

The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare.

The wage bracket method and the percentage method. Your employer withholds 145 of your gross income from your paycheck. The amount withheld depends on.

Now use the 2022 income tax withholding tables to find which bracket 2025 falls under for a single worker who is paid biweekly. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. You pay the tax on only the first 147000 of your.

How It Works. There are two main methods small businesses can use to calculate federal withholding tax. There are no income limits for.

You find that this amount of 2025 falls in. Youll pay 62 and 145 of your income for these taxes respectively. Although this publication may be used in certain situations to figure federal income tax withholding on supplemental wages the methods of withholding described in this publication.

How Your Paycheck Works. The withholding tables have tax brackets of 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Federal income tax and FICA tax.

How withholding is determined. It depends on. For a hypothetical employee with 1500 in weekly.

FICA taxes consist of Social Security and Medicare taxes. Ad Compare Your 2022 Tax Bracket vs. Use this tool to.

Your employer pays an additional 145 the employer part of the Medicare tax. The amount of income earned and. Withholding tables PDF Publication 15 PDF Calculate Your Employment Taxes Foreign Persons Most types of US.

Backup withholding rate remains 24. To arrive at the amount subject to withholding subtract 330 from 1700 which leaves 1370. Every pay period your employer withholds 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes.

Payroll Tax What It Is How To Calculate It Bench Accounting

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

How To Calculate Federal Income Tax

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

Calculating Federal Income Tax Withholding Youtube

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

Spending Plan Worksheet How To Plan Dave Ramsey Budget Percentages

45 Of Americans Don T Know How Much Tax Is Withheld From Their Pay

Payroll Tax Vs Income Tax What S The Difference

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

Paycor Infographics Payroll Tax Deductions Infographic Paycor Payroll Taxes Tax Deductions Payroll

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

Are Federal And State Taxes Withheld As A Percentage Of Your Pay In The Us Quora

Irs New Tax Withholding Tables

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube